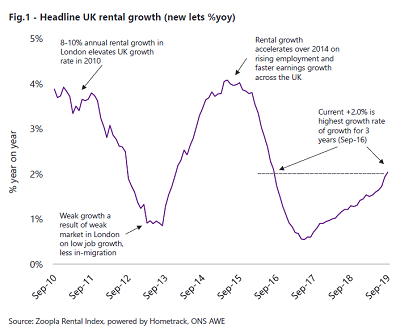

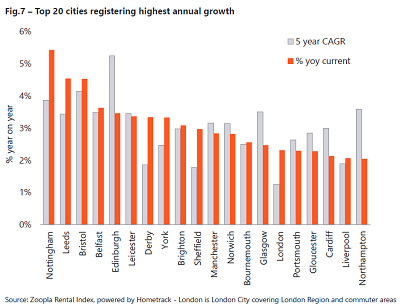

We take a look at how Brexit is affecting the property market, focusing on the annual rate of the UK rental growth for new lets compared to previous years and which cities are in the top 20 for the highest annual growth.

Peter Scully | 18th October 2019

London doesn’t like Brexit. The city has been quite clear about this. Its property market certainly doesn’t like Brexit, although it’s important to note that there are almost certainly many other factors influencing the current slowdown.

London doesn’t like Brexit. The city has been quite clear about this. Its property market certainly doesn’t like Brexit, although it’s important to note that there are almost certainly many other factors influencing the current slowdown.

In fact, the single, biggest issue slowing down the London housing market is probably the continued lack of affordability, rather than Brexit, although concerns over Brexit are unlikely to be helping matters.

So London is probably not the best place for most property investors right now, fortunately, however, the UK has plenty of other options, including cities which are in a much better position to deal with Brexit.

In simple terms, Brexit relates to the UK’s relationship with the EU, hence cities which are in a good position to weather Brexit are cities which have strong trading relationships with non-EU countries, or show signs of being able to develop them quickly.

London is a global city, however, it is dominated by financial services and it is common knowledge that the financial-services industry is very concerned that a hard Brexit could severely impact its profits, at least in the short term, by forcing the UK to withdraw from lucrative EU markets.

Admittedly, financial institutions elsewhere in the EU would be forced to withdraw from the UK, but in terms of financial services, right now, the UK does more exporting than importing and the loss of this market would hit London much harder than any other part of the UK.

Affordability and demand are the two supporting pillars of property investment and anyone familiar with London will know that, currently, it only has one of them.

As previously mentioned, affordability is, generally, very poor (as with most cities there are occasional bargains to be had if you look long enough and hard enough or if you just get lucky, although luck is not a good investment strategy).

Demand is certainly high, (Brexit notwithstanding), but it is practically impossible for buy-to-let investors to set rents at a level which makes it possible to achieve decent yields. Some property investors were prepared to accept this in return for capital appreciation, but this is not happening right now.

The opposite of London are the UK’s rural areas where affordability is often outstanding but where demand is low.

At this point in time, it’s hard for property investors to go too far wrong in these areas, but there are some cities which stand out in particular. Birmingham and Manchester are probably the best places for people who prefer to invest in mature markets but still want good affordability.

Neither of these cities is the bargain it once was, but both continue to offer good prices and good yields. Leeds, Liverpool and Sheffield are all fairly mature but still being regenerated.

These cities are still rather in the shadow of Birmingham and Manchester but they all have popular universities and their economies are global rather than EU-centric. Last but no means least there is Newcastle, which is still rather under-the-radar but which is showing massive potential.

If you would like to discuss any property investment opportunities or are looking to sell your investment, feel free to call us on 0161 660 9684 or email us on enquiries@pureinvestor.co.uk

Call our team today on +44 (0) 161 337 3890