Asking yourself if London is THE place to invest in 2024-25? Naturally, London has been the go-to spot for investing in property, both commercial and domestic for decades. It still holds its reputation even today and continues to be fierce competition for neighbouring cities, and cities around the world.

Investment opportunities continue to present themselves, and property investors both new and experienced are looking to get in on the action.

Before we delve into our complete London property investment guide, here’s what you can expect to discover:

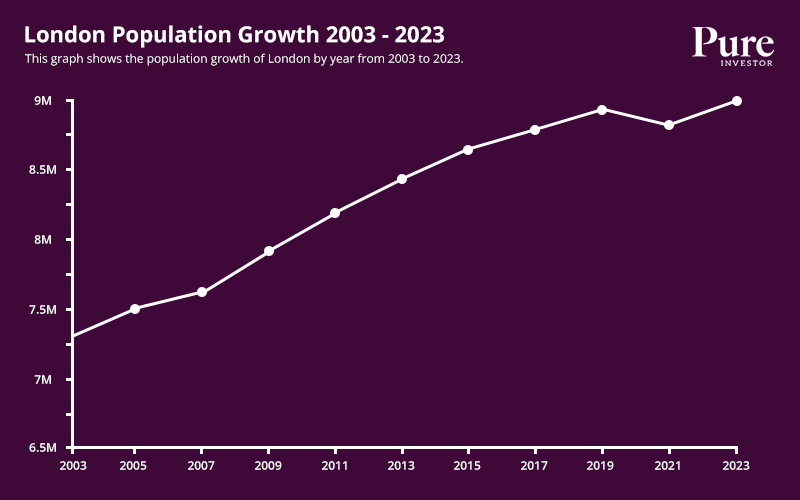

London’s population has increased by 1.04% since 2023 to 9,784,000 but has increased by 3.14% since 2020.

London has an average median age of 35.9 (with the average age of a first-time buyer being 34).

Average monthly rent in London is £2,121.

London takes home the headquarters of some of the largest banks, such as Lloyds Banking Group. Making London one of the safest places to live and invest in economically. It has been predicted that the rate of the economic increase in London is faster than cities like New York and Paris, and as of 2024, London has been listed as the fourth largest economy in the world.

The good news about London is its youthful population, on average there are more births than deaths and with an average age of 35/36 the majority of individuals are in the next phase of their life of buying their first home. This bodes well for investors interested in various domestic property investments such as buy-to-let and new-builds.

Interesting data regarding the increased London population explores how people’s priorities have changed again since the pandemic. As many were previously moving out of the centre of London in search for garden space and home-office potential, people are now moving back into the city as many businesses end their way of remote working, leading to further demand for suitable housing.

Additionally, rental property is experiencing increasing attention as the city continues to attract a younger generation looking to work and study. Young adults are also looking for more modern features included within their accommodation whether that be private garages, onsite gyms and even rooftop gardens.

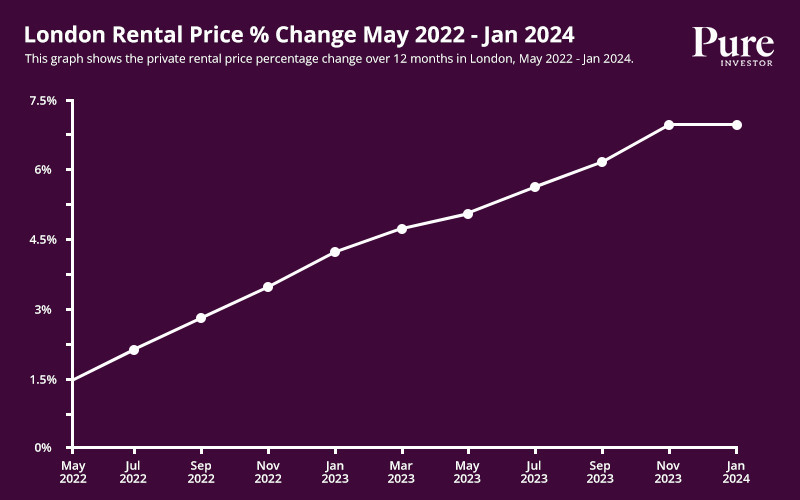

The average recorded rental price from April 2023 was £2,121 and has seen considerable growth over the last couple of years. Rental prices may also increase, naturally, the closer the property is to the centre.

As the City of London offers some of the most luxurious developments to invest in, it’s no wonder that the rental sector is increasing at a faster rate than house prices. Investors can expect to see rents increase, not twice, not three times but potentially four times faster over the next several years.

Some data has stated that the average rent in Britain will be 25% higher in 2026 than it was in 2022, with the average house price being only 5.5% above that.

Various sources claim that London has experienced a significant growth in investment from overseas buyers since the end of 2022. From investments into commercial property and infrastructure projects that benefit local areas and general quality of life.

A survey from the LPA also revealed that London was the top-ranking city for new homes completed, Foreign Direct Investment (FDI) and prime office rents, specifically in the West End.

Another extremely important contributor to the London economy is tourism, with the City of London being at the forefront of the city’s tourism market. In addition to this, this makes the city a high demand area for overseas investors due to the increased demand for short term rentals from tourists visiting the city.

| District | (%) Average Rental Yield |

|---|---|

| Camden | 5% |

| Islington | 4.7% |

| Hackney | 5.4% |

| Kensington & Chelsea | 4.8% |

| Hammersmith & Fulham | 5% |

| Lambeth | 4.9% |

| Southwark | 5.3% |

| Tower Hamlets | 5.8% |

| Westminster | 4.4% |

If you’ve travelled to London, you’ll be aware of the extensive transport infrastructure, from the London Underground, overground, countless bus routes and trams, if there’s somewhere you want to visit in London there should be no trouble getting there.

The London Infrastructure Plan 2050, originally set out by Boris Johnson in 2015 aims to address various areas of infrastructure that will benefit all Londoners, including housing, digital infrastructure, energy and transport.

Currently the HS2 continues to take shape with this due to be completed between 2029 and 2033, once complete this will connect neighbouring cities such as Manchester, Birmingham and Sheffield.

As an investor, you’re looking for a location that offers much more than just a property, but a way of life, and although London is a hot spot for entrepreneurs and young professionals it’s also a city that’s full to the brim with unique and specialist experiences.

With over 67,000 amenities, you could consider London as a City of play. From the Royal Albert Hall and Wembley Stadium to 80 Michelin-starred restaurants and free museums to endless tourist attractions that will keep you roaming the city for hours.

Data suggests London has been attracting growing numbers of visitors each year, with over 25 million visitors predicted to visit in 2024 alone.

London is home to more than 400,000 students from more than 200 different countries studying at its more than 40 universities and higher education institutions. This unparalleled level of educational interest creates extremely high levels of demand for PBSA and affordable accommodation.

These factors make the city one of the most attractive areas for student property investment in the country. In addition to this, London offers very generous returns on student property and a range of investment opportunities from more entry-level properties to higher spec properties that can offer better returns. When it comes to student property, London really does have it all.

| District | 2023 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| Camden | £807,865 (1460) | £7,584,874 (33) | £3,443,173 (77) | £2,238,302 (227) |

| Islington | £637,187 (1367) | £2,359,270 (6) | £2,271,980 (28) | £1,476,520 (436) |

| Hackney | £568,982 (1461) | £1,689,400 (5) | £1,660,147 (35) | £1,176,545 (408) |

| Kensington & Chelsea | £1,426,118 (1350) | £18,043,015 (18) | £10,559,740 (46) | £4,122,342 (340) |

| Hammersmith & Fulham | £730,430 (1404) | £2,278,778 (5) | £1,982,171 (35) | £1,577,845 (577) |

| Lambeth | £508,626 (2301) | £1,498,702 (43) | £1,198,104 (163) | £984,117 (643) |

| Southwark | £515,574 (1864) | £2,081,883 (39) | £1,417,323 (96) | £946,909 (493) |

| Tower Hamlets | £527,822 (2128) | £2,500,000 (3) | £1,083,586 (7) | £860,894 (210) |

| City of London | £1,022,370 (167) | £0 | £0 | £2,125,068 (2) |

| Westminster | £1,605,347 (2198) | £8,093,375 (14) | £6,228,636 (22) | £3,541,130 (243) |

| District | 2022 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| Camden | £860,635 (1954) | £5,306,798 (47) | £3,476,360 (69) | £2,255,924 (314) |

| Islington | £641,141 (1852) | £2,271,853 (11) | £2,047,841 (49) | £1,557,224 (467) |

| Hackney | £575,462 (2281) | £1,800,233 (15) | £1,527,280 (53) | £1,174,584 (507) |

| Kensington & Chelsea | £1,577,825 (1757) | £11,139,333 (21) | £11,840,081 (31) | £4,646,386 (512) |

| Hammersmith & Fulham | £707,731 (1853) | £1,974,600 (10) | £2,497,081 (46) | £1,603,079 (722) |

| Lambeth | £547,520 (3276) | £1,314,742 (45) | £1,215,968 (243) | £981,371 (896) |

| Southwark | £524,709 (2636) | £2,055,579 (61) | £1,343,755 (137) | £943,363 (763) |

| Tower Hamlets | £606,250 (4293) | £1,783,000 (5) | £825,439 (15) | £872,882 (319) |

| City of London | £1,106,547 (210) | £0 | £0 | £950,000 (1) |

| Westminster | £1,687,918 (2987) | £7,866,991 (20) | £4,954,381 (24) | £3,583,783 (391) |

| District | 2021 Flats | Detatched | Semi-Detached | Terrace |

|---|---|---|---|---|

| Camden | £864,073 (2316) | £5,819,358 (43) | £3,072,979 (105) | £2,106,134 (357) |

| Islington | £635,944 (2073) | £1,674,792 (12) | £1,957,474 (60) | £1,435,195 (535) |

| Hackney | £560,237 (3243) | £1,871,100 (10) | £1,384,129 (68) | £1,100,007 (604) |

| Kensington & Chelsea | £1,394,719 (1795) | £14,439,365 (13) | £9,206,035 (45) | £4,108,200 (515) |

| Hammersmith & Fulham | £698,769 (2185) | £3,354,667 (15) | £1,872,982 (60) | £1,506,912 (894) |

| Lambeth | £552,540 (3857) | £1,560,281 (61) | £1,088,219 (271) | £949,625 (1127) |

| Southwark | £544,439 (2941) | £1,919,077 (51) | £1,293,638 (185) | £936,360 (846) |

| Tower Hamlets | £606,023 (5280) | £1,112,500 (1) | £911,281 (16) | £918,557 (352) |

| City of London | £1,028,947 (244) | £19,500,000 (2) | £0 | £3,033,333 (3) |

| Westminster | £1,481,743 (3014) | £7,381,308 (27) | £5,354,158 (31) | £3,325,860 (379) |

Number in brackets is the total number of sales.

Data provided by Gov UK Land Registry.

Average rental yield – 5%

Average house price – £ 1,225,933

If Camden has caught your eye as the next spot for your buy-to-let investment, you’ve picked a good spot. Located north of central London, Camden has excellent transport links and has been revitalised from growing investment into the area and general infrastructure.

It has one of the highest average property prices across London, coming in at £797,000 as of May 2024, which although is a decrease compared to 2023, this only makes the area that more popular as people can see the value of purchasing or renting in this area whilst the cost is lower.

Many will consider Camden to be a trendy, fashionable location within London that offers an attractive social scene full of cafes, bars, restaurants and shops. Camden has continued to build its popularity by offering a variety of sought-after jobs in attractive industries such as finance, tech and media. For graduates looking to start their new life, Camden certainly has plenty to offer.

Average rental yield – 5.8%

Average house price – £ 561,788

Located to the north of Westminster and Hyde Park, Tower Hamlets is an excellent option for those looking to invest in London property. The district is in close proximity to the city centre and many of the most visited attractions that London has to offer.

Tower Hamlets has high rental yields while also offering lower average house prices compared to other parts of the city. This makes the area very attractive to all investors since properties here are more likely to offer a better bang for your buck.

Investment and regeneration in the area is also active with various projects underway. One such example is the council’s Local Investment Plan which includes plans to build new homes in the area as well as regenerate various other areas of the borough.

Average rental yield – 5.3%

Average house price – £ 660,157

Southwark has long been a favourite among London property investors due its excellent rental yields, comparatively low house prices, and its tourist attractions which include The Shard and London Bridge.

The borough has excellent transport links from several major stations including the London Bridge, Southwark, and Elephant and Castle stations. The links from Southwark allow residents access nationally and internationally, connecting to London’s airports and beyond.

The area is also rich with culture and leisure activities making it attractive to prospective tenants. The borough is home to the National Theatre and the British Film Institute.

Average rental yield – 5%

Average house price – £ 997,877

Hammersmith & Fulham is a popular area for anyone looking to put down their roots, especially families, as the area boasts an aura of safety and community and is considered by many in the local area as quiet and peaceful.

That doesn’t mean Hammersmith & Fulham has little else to offer, in fact, there’s plenty of life along the main town areas including the Hammersmith Apollo venue and striking architecture as well as the abundance of restaurants, bars and cafes to revel at.

Getting around Hammersmith & Fulham has never been easier, as its locality serves well for those travelling in and out of central London and has excellent transport links including three main tube lines and a large bus station.

Investors can discover various opportunities to expand their portfolios and enjoy the many benefits Hammersmith & Fulham has to offer, both from an investment point of view and as a resident living in this fantastic location.

Average rental yield – 4.9%

Average house price – £ 654,879

Lambeth has a solid reputation for being a fantastic place for exciting job opportunities with many achievements such as being in the top 10 for overall Ofsted performance out of 33 London boroughs, which will also go down well with families looking to relocate or live in Lambeth.

It’s one of the 4th most densely populated areas in Britain and boasts a diverse population of various ages. Naturally, as its home to the London Eye it also attracts many visitors and when visitors aren’t enjoying the horizon, they’ll definitely be enjoying the many attractions and landmarks the area has to offer.

With all this excitement, how does the property market stack up? Average house prices in Lambeth are around £654,879 and investors can seek out various property types from luxury apartments and student accommodation to family centred housing which offers a quieter slice of Lambeth.

Between 2025-2028 house prices are predicted to rise by 17.5% and with the current increase of rental prices, now is a great time to invest in London property.

With property markets being shaken up across the UK since 2020, buyers have been more cautious and high mortgage rates have made it increasingly difficult for people to buy new homes. So, how will London fare into 2025 and beyond?

A report from Savills in Feb 2024 demonstrated the gap between available housing and the ever-growing London population. As set out in the report, if housing cannot be delivered to keep up with the pace of those living in London, demand will increase and so will returns for investors.

We genuinely believe in working with our clients, providing a high quality of service and information, allowing our clients to make their decision on a more informed basis. As a result of this, an increasing number of investors are choosing to return and utilise our services on an ongoing basis. This is something we are incredibly proud of, and which we are looking to continually improve on in the future.

If you are considering investing in a property in London, and don’t fancy the ‘hard sell’ approach, please feel free to get in touch on either enquiries@pureinvestor.co.uk or call us on 0161 337 3890.

We look forward to hearing from you!

Call us on +44 (0) 161 337 3890 or contact us using the form below to arrange your free no obligation property consultation.